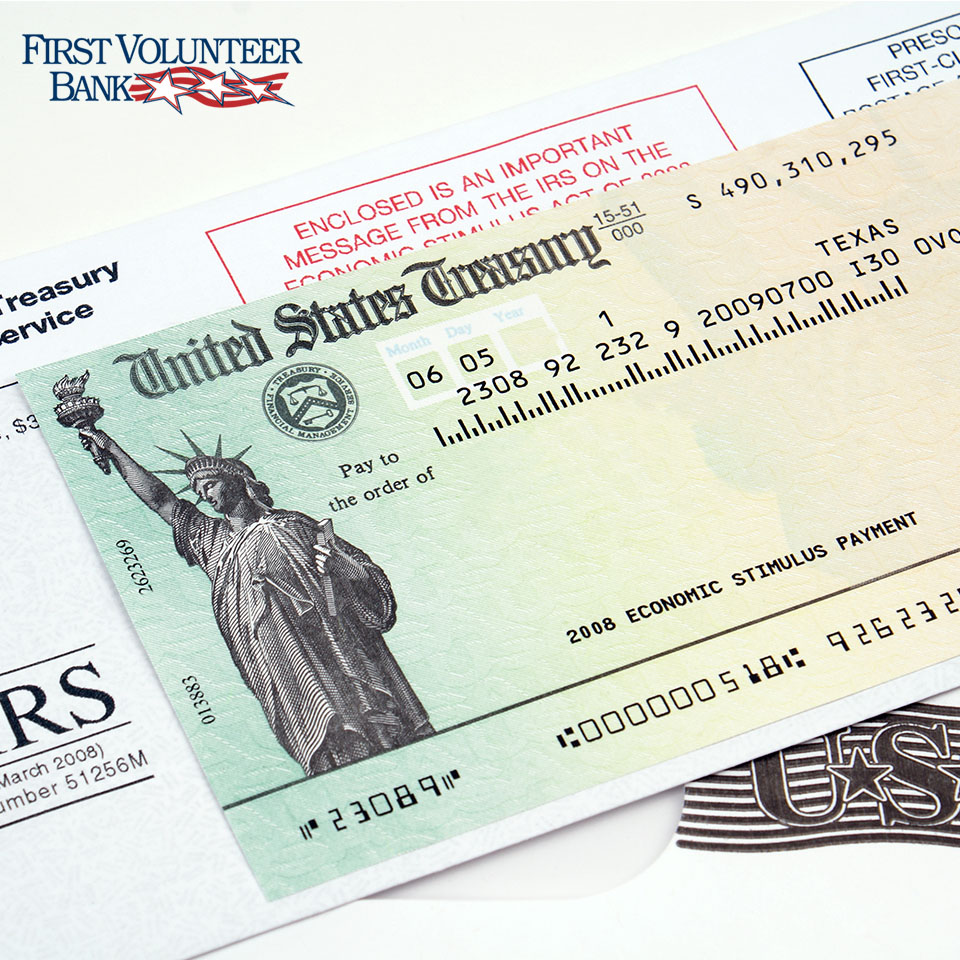

Getting the Most From Your Tax Return This Year | First Volunteer Bank

Tax Day approaches. While the due date for our income tax returns is usually April 15, this year the date falls on April 17. While that date might seem far off in the future, our team at First Volunteer Bank wants to help you go ahead and prepare for tax day now!

Boost Your Tax Refund

According to the IRS, the average tax refund is $3,120. Do you typically get more or less?

Let’s take a look at ways you can optimize your tax refund this year.

First, you want to consider your filing status. Your filing status can affect your tax refund in many ways, especially if you are married. While most married couples file jointly, there are some times when married-filing-separately works out better in the end. Therefore, it is important to look at your tax filings both ways to see which will work best for your individual circumstances and finances.

Second, you also want to make sure you’re declaring all possible deductions and credits you qualify for. If you aren’t sure which ones work for you, check into tax preparation software or working with a tax professional. Software will typically step you through all deductions, asking questions about your individual circumstances to determine whether you’re eligible. A tax professional will do the same to help ensure you aren’t leaving money on the table.

Finally, if you have an IRA, maximize your contributions. You have until April 15 to open a traditional IRA for the previous tax year. Contributions to that account aren’t taxable until you withdraw them, and they reduce your tax burden for the current year.

What are your plans for your tax refund? Why not put it into a savings account for a rainy day? Visit the First Volunteer Bank website to learn about our savings account options!